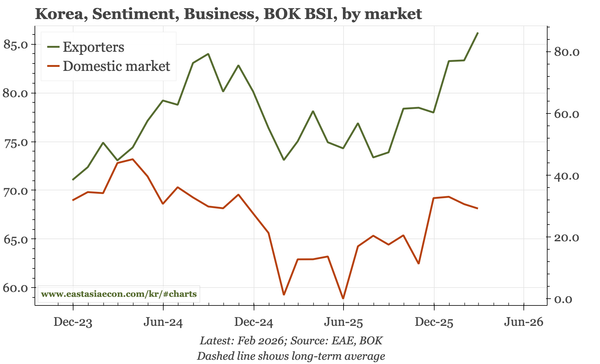

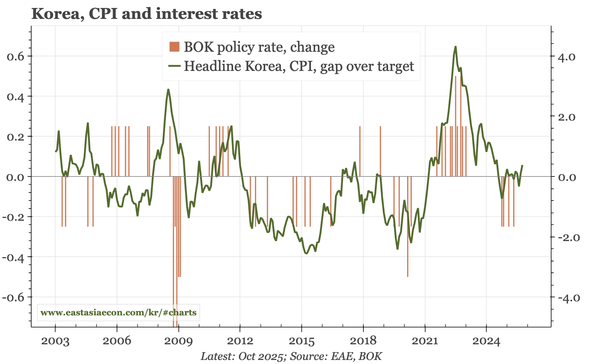

Korea – BOK remains cautious

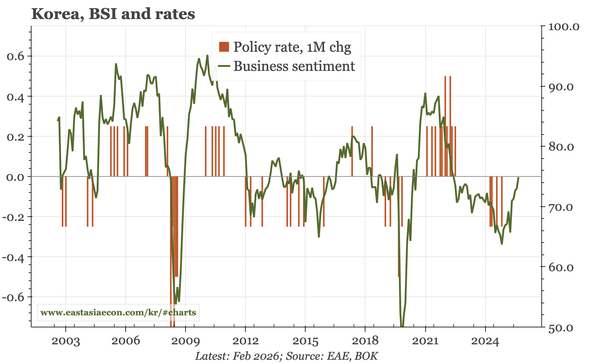

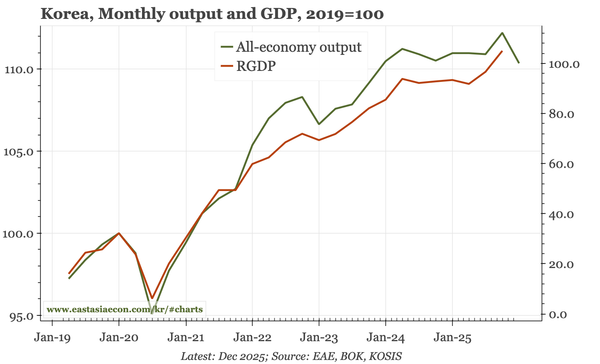

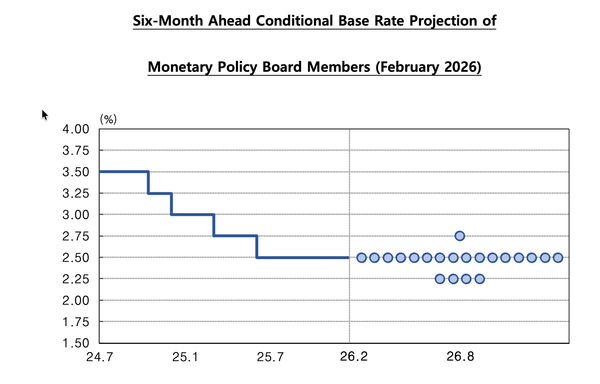

The tone from today's BOK meeting was cautious. The new rate dot plot suggests that at the margin risks for policy are still weighted towards loosening, the upgrade to the GDP growth forecast was only 0.2ppts, and having made that change, the bank thinks risks to the outlook are now balanced.