Korea - close to cutting territory

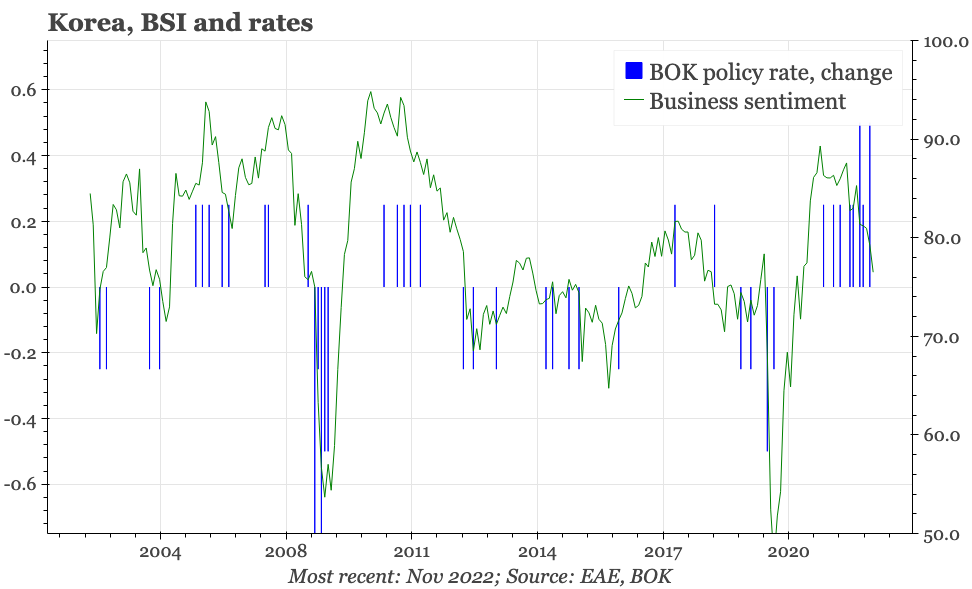

It didn't quite there yet in November, but in the next couple of months business sentiment will most likely be back at levels where, far rather than hiking 50bp, the BOK has historically been cutting.

November business sentiment

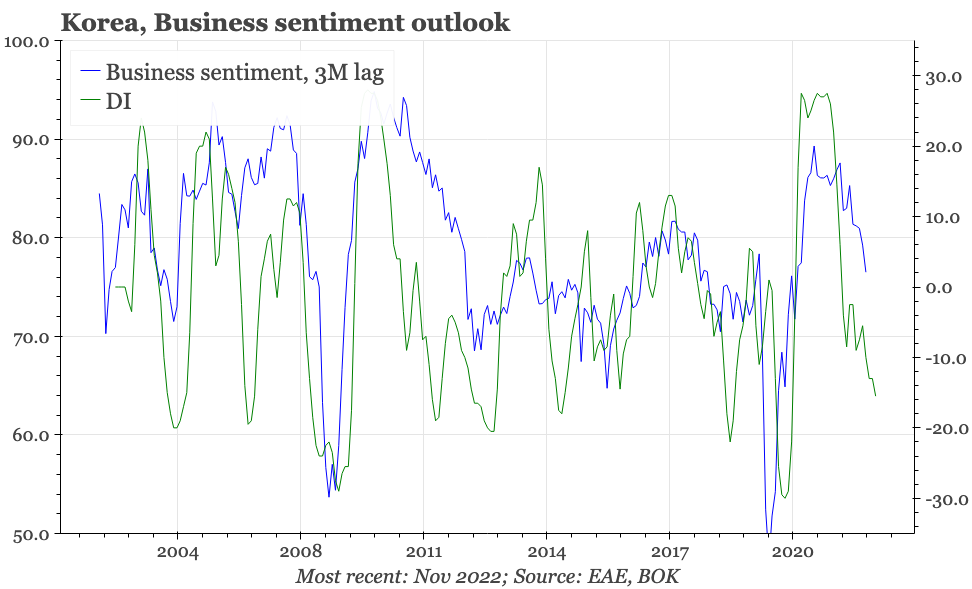

Business sentiment has been easing for a while, but the pace of decline has picked up in the last couple of months. The diffusion by industry points to this accelerated rate of fall continuing. If that proves right, sentiment will soon be at a level where the BOK has usually been cutting rates.

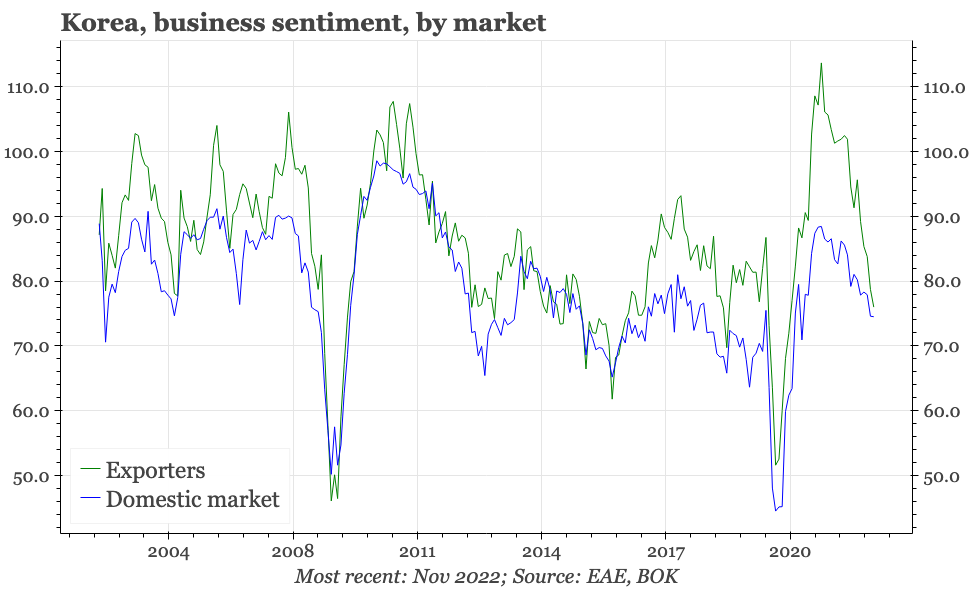

The weakness continues to be led by companies selling outside of Korea, with exporter sentiment in November (the survey includes a 1M outlook) down to 76. That is quite the fall from the almost 115 recorded in mid-2021. The decline in exporter sentiment has been lagging the weakening of actual exports. Our regional model continues to point to more downside for exports: it is currently indicating exports will be falling 15% YoY in the next few months.

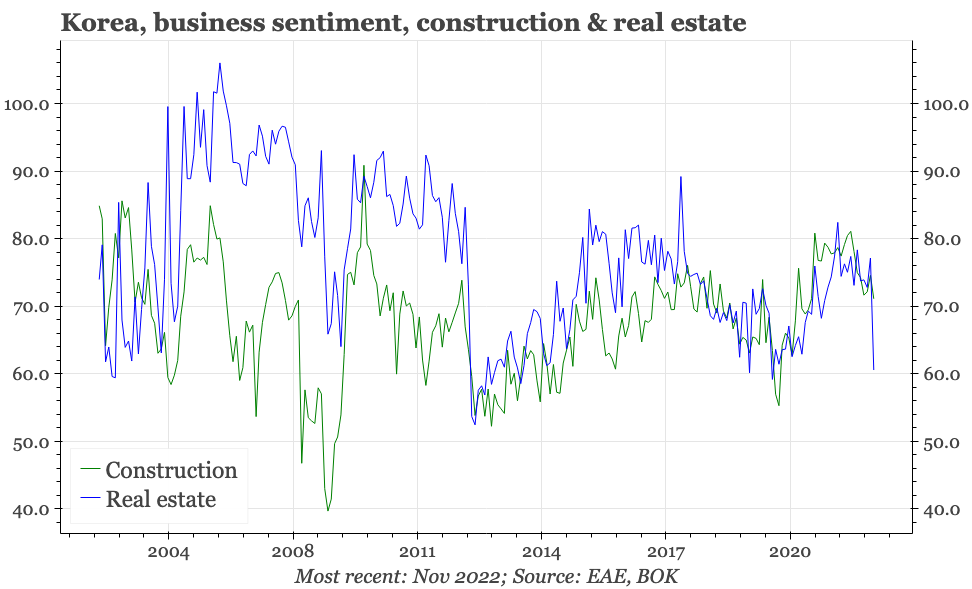

Sentiment among domestically oriented firms is also falling, but more gradually, and with quite some variation by industry. Hospitality firms, which have benefited from the post-covid normalisation of consumption, remain confident, though sentiment is now beginning to moderate a little. Sentiment among real estate firms, by contrast, declined sharply in November, which makes sense given the big fall in buyer sentiment shown by the consumer confidence survey. With exports and construction weakening, the turn in the industrial sector is shaping up to be quite dramatic.

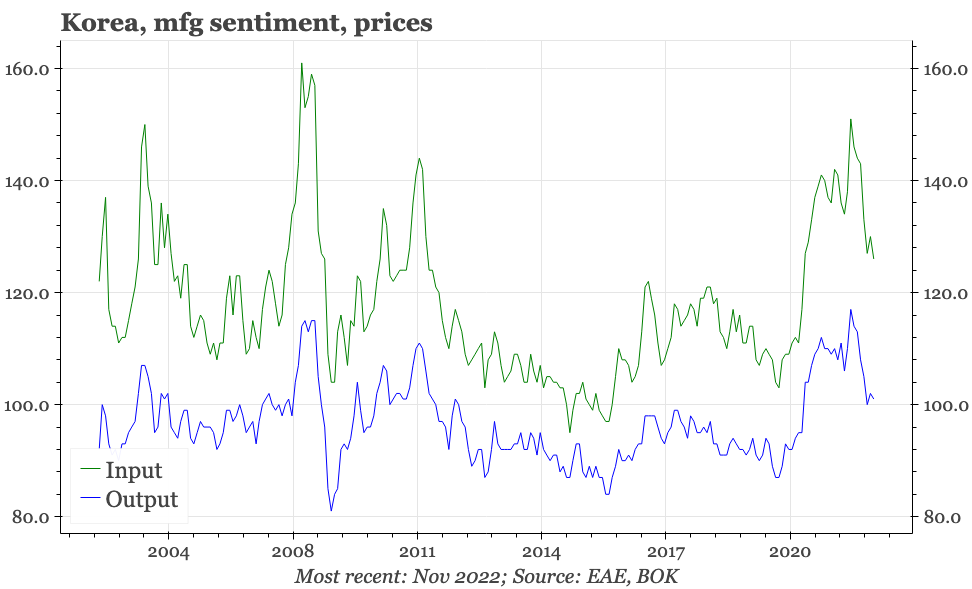

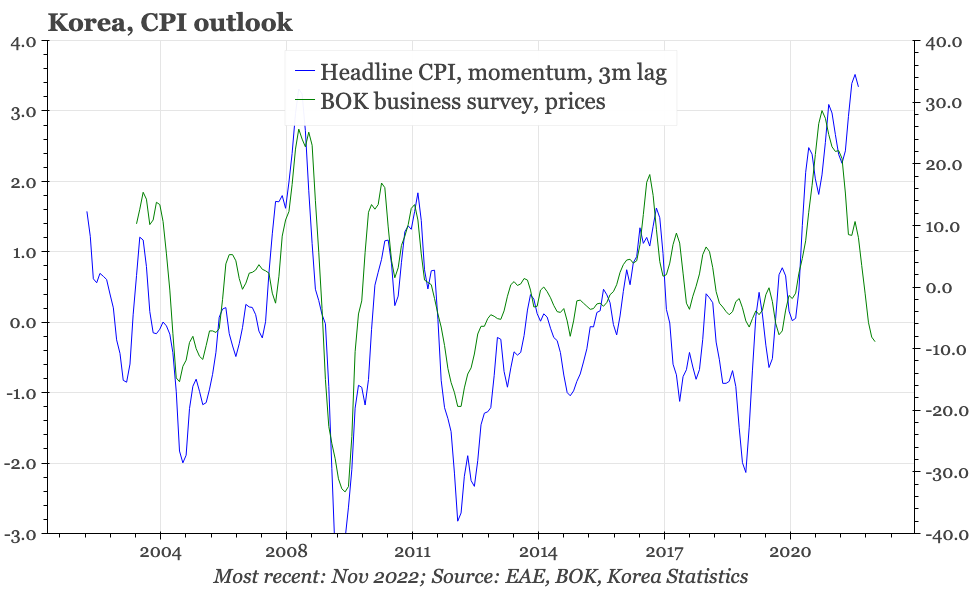

In manufacturing, both input and output prices ticked up this month. The YoY change is, however, still down. As has been the case for a few months already, this suggests that there will be a pronounced decline in inflation momentum in the next few months. There is a caveat to this though: the survey just measures manufacturing prices, and so is probably more relevant as an indicator for headline inflation, not necessarily core.