Korea – more K than elsewhere

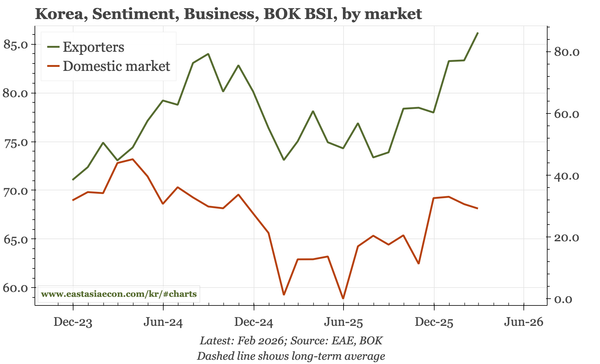

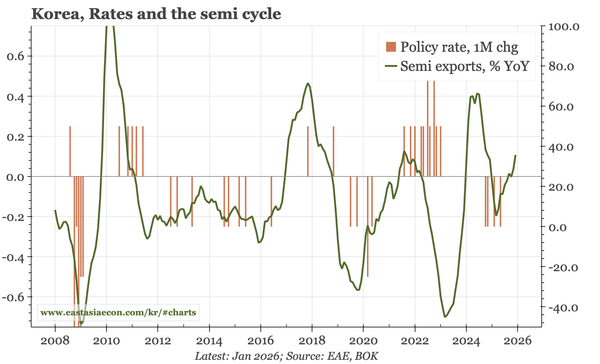

Headline business sentiment has improved to take the BOK back towards neutral. But the details are mixed, with Korea's recovery more K-shaped than it has been before. With the semi cycle lifting exports, the BOK is now unlikely to ease further, but the bank still needs to see more domestic recovery.

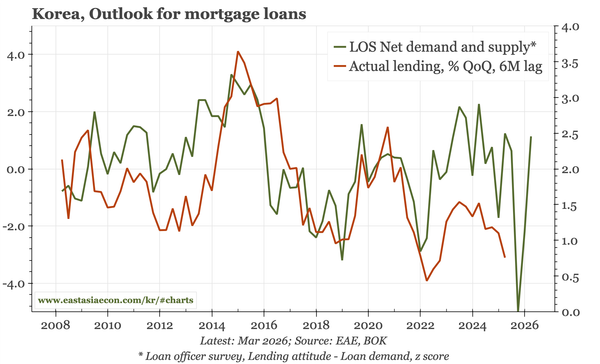

Korea – economy weak but housing firm

Today's Q4 GDP data show the economy contracted again late last year, and grew just 1% in 2025 as a whole. That partly reflects weak construction, but facilities capex is also weak. And yet, this week's Loan Officer Survey warns of no lasting slowdown in housing.

Korea – "upside risks have increased"

The BOK isn't getting carried away by the remarkable rise in semiconductor prices, but it did today say the chip cycle is moving growth risks to the upside. It also terminated talk of rate cuts, though that isn't just about growth, with the bank making clear that KRW weakness is a key consideration.

Korea – unchanged, except for DRAM

Domestic sluggishness and financial stability concerns aren't changing, so likely keep the BOK on hold tomorrow. But there is a new development: the 10x rise in the DRAM price. To me, that is shifting cycle risks to the upside. Tomorrow's meeting will be important if that is the bank's view too.

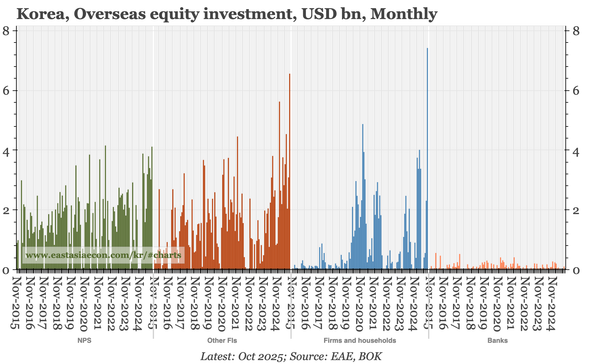

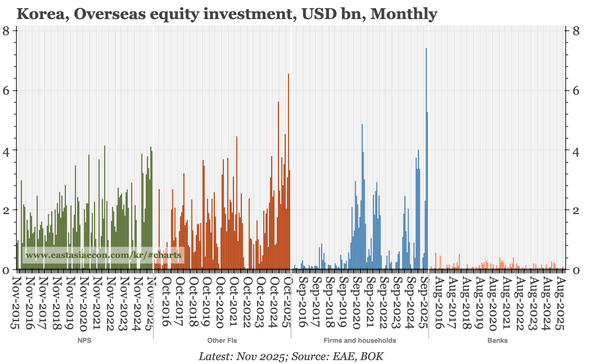

Korea –outflows still strong in November

November BOP data show another big current account surplus – and more big outflows into offshore equities. We can't be sure that outflows have yet peaked. But with the KRW cheap, semi exports gaining momentum and the government taking KRW stabilisation measures, risk around the currency are shifting

Korea – PPI inflation picking up

The mild rise in PPI goods inflation reflects the continued strength of import prices. Services PPI inflation is picking up too, reversing the sharp fall of 1H25. Neither development yet suggests CPI inflation is about to accelerate, but the bounce in services PPI removes downside risk for CPI.

Korea – BOK optimistic on exports, and consumption

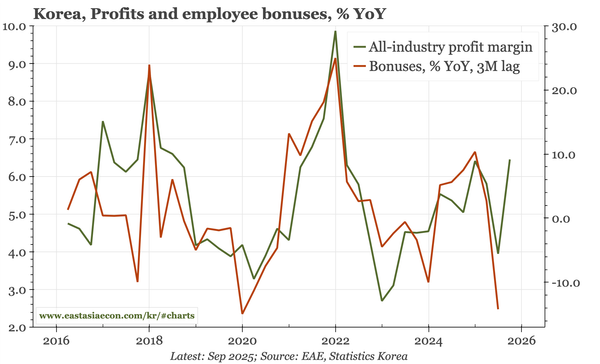

The BOK minutes shed more light on the improvement in cycle optimism that was clear at the November meeting. In terms of exports, that appears justified, because of strong semi exports and firmer profits. I am less sure about consumption, even though corporate earnings will lift bonuses.

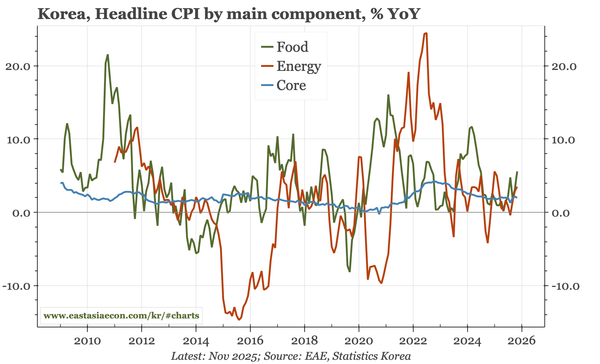

Korea – core inflation stable, but not low

The BOK says the rise in headline CPI inflation to 2.4% the last couple of months is temporary, and that core is stable. That isn't an unreasonable assessment. However, I'd continue to highlight the strength of services inflation, which remains firm reltive to ongoing labour market weakness.