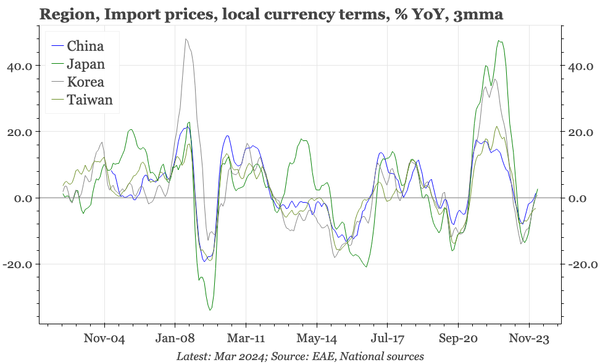

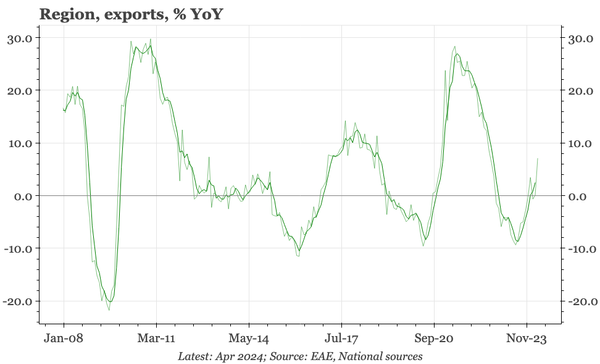

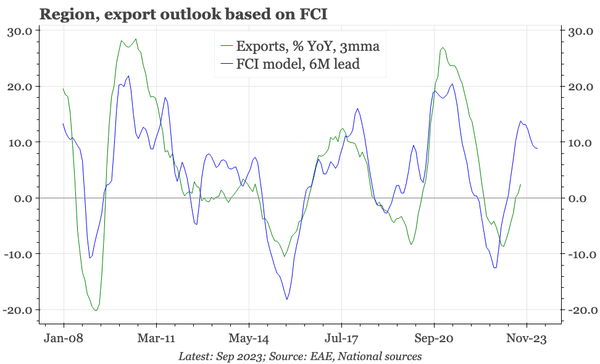

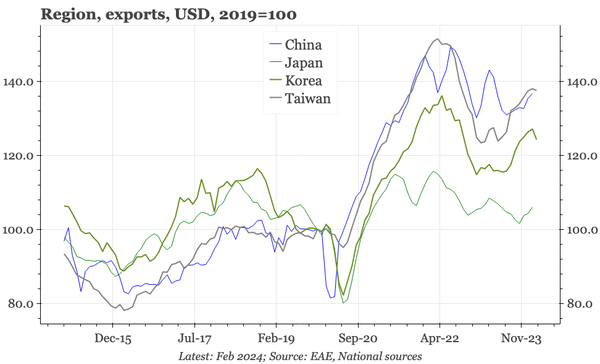

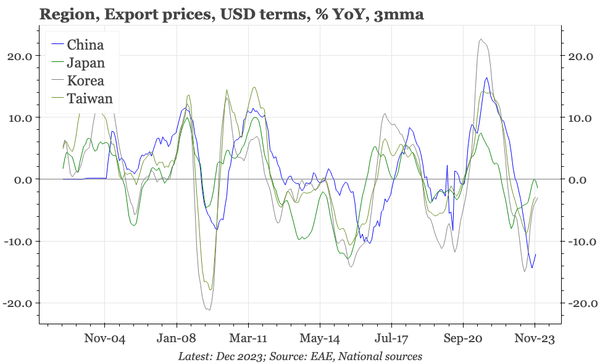

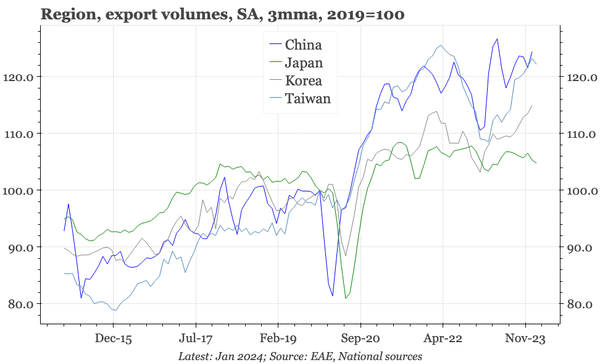

Region – export recovery still mixed

The export cycle is recovering, but more in volume than value terms, and in Taiwan and China than Korea. This won't remove worries about weak consumption in Korea and China. But it likely is sufficient to keep Taiwan's economy tight, and the CBC will likely be hiking again if exports rise more.

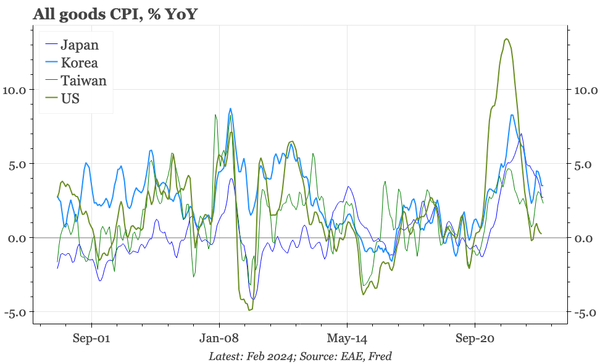

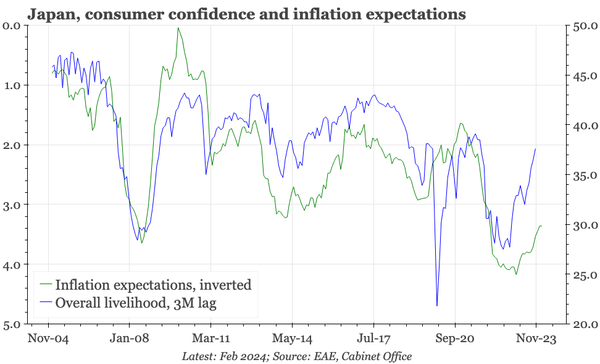

Region – the structural rise in wages

Not just in Japan but Taiwan too, there are signs of a structural break from persistently low wage inflation. The implication is that the gap between nominal monetary settings between both and the US is likely to be narrower in the future than it has been in the past.

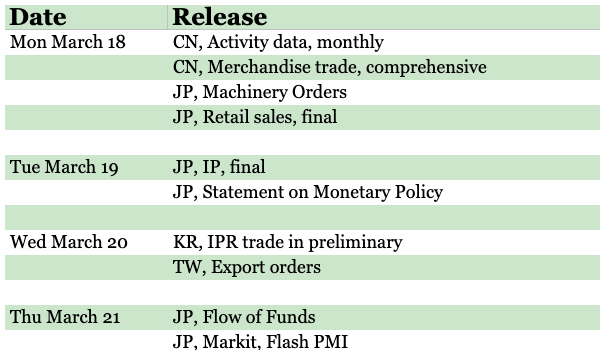

Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

Region – manufacturing cycle

It is always tricky to get a real sense of the manufacturing cycle early in the year when the data are so distorted by the LNY holiday. From what we can tell, it doesn't look like there's been a big pick-up yet, though leading indicators continue to point to upside ahead.

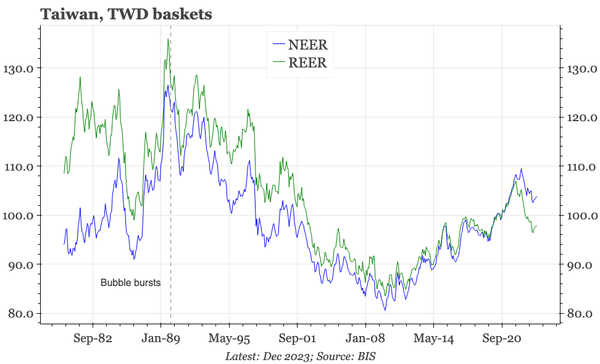

Region – the end of secular depreciation

A chart pack presenting a framework for regional currencies. We use secular JPY and TWD depreciation to lay out the framework; apply that to the CNY today; and finally, argue that there are reasons to think the structural weakening of the TWD and JPY is likely ending.

Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

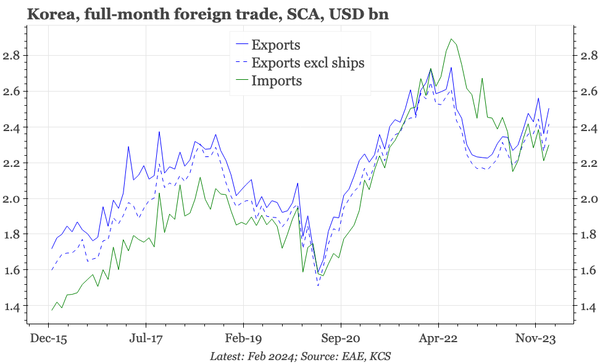

Region – as Korea, so the world?

Korea's trade surplus with China has collapsed, taking with it Korea's overall surplus. This offers a clear illustration of China's competitiveness, and argues for CNY strength, not weakness. But it also indicates that the relative fundamentals for the KRW are also deteriorating.

Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

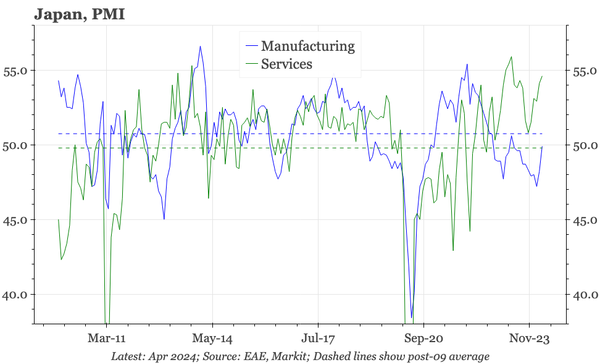

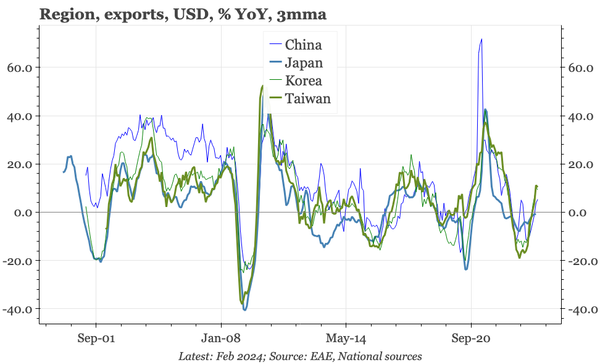

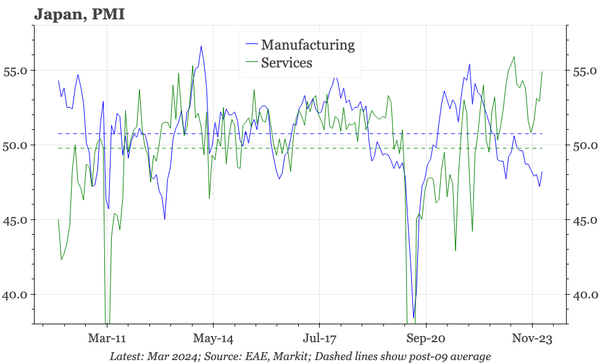

Region – PSL and PMIs

With the Markit PMI holding up and PSL funding rising, China doesn't look as bad as market sentiment. Exports in Korea and PMIs in Korea, Taiwan and Japan show the industrial cycle improving, but not quickly. For Japan and Korea, that can still be important given elevated non-manufacturing PMIs.

Region –monthly chart pack

A slide pack summarising our recent research and views on the region