Taiwan – hitting a wall

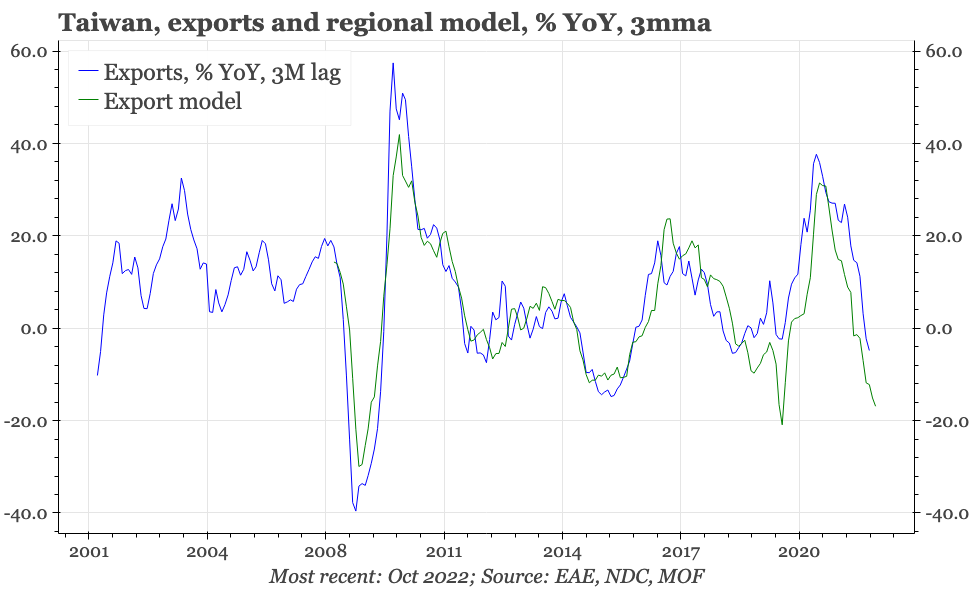

The last time exports dropped as quickly as they have recently was in the global financial crisis in 2008-09. This time around, the fall does come after a particularly large increase. Even so, with exports falling and inflation low, further rate hikes are unlikely, and cuts are possible.

November foreign trade and inflation

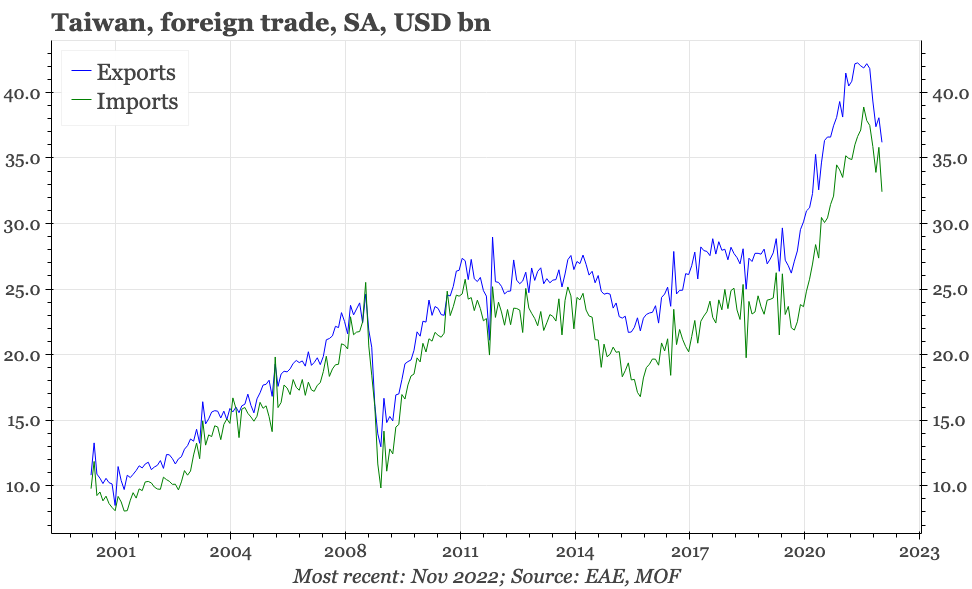

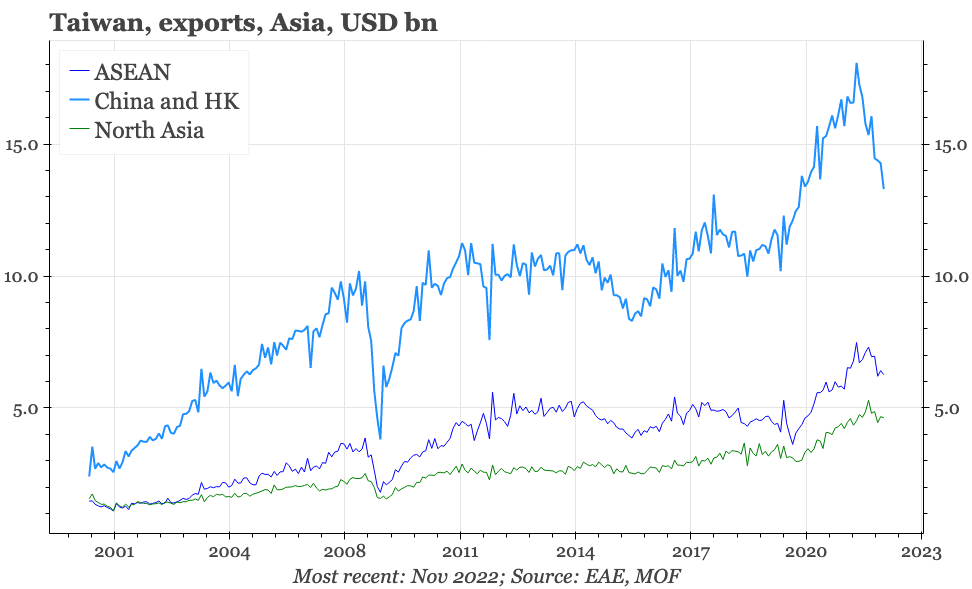

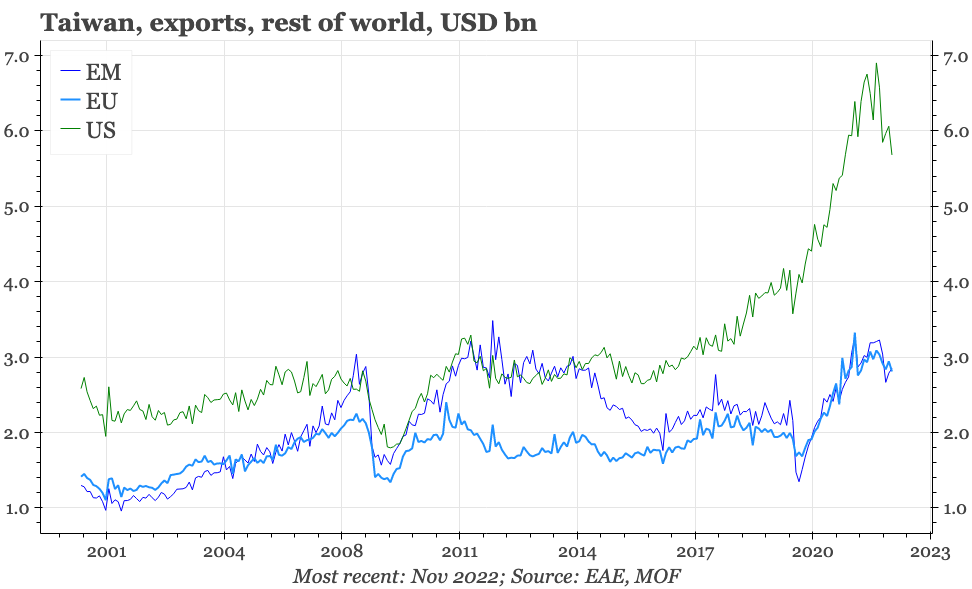

Exports fell 13% YoY in November, and on a level basis have now dropped 15% just since June. The last time exports weakened this quickly was during the global financial crisis in 2008-09. As has been the case for the last few months, China remained the leading source of demand weakness in November – shipments to the other side of the Taiwan Strait have fallen more than 25% in the last nine months. But exports to the US are now dropping too, declining 6% in November.

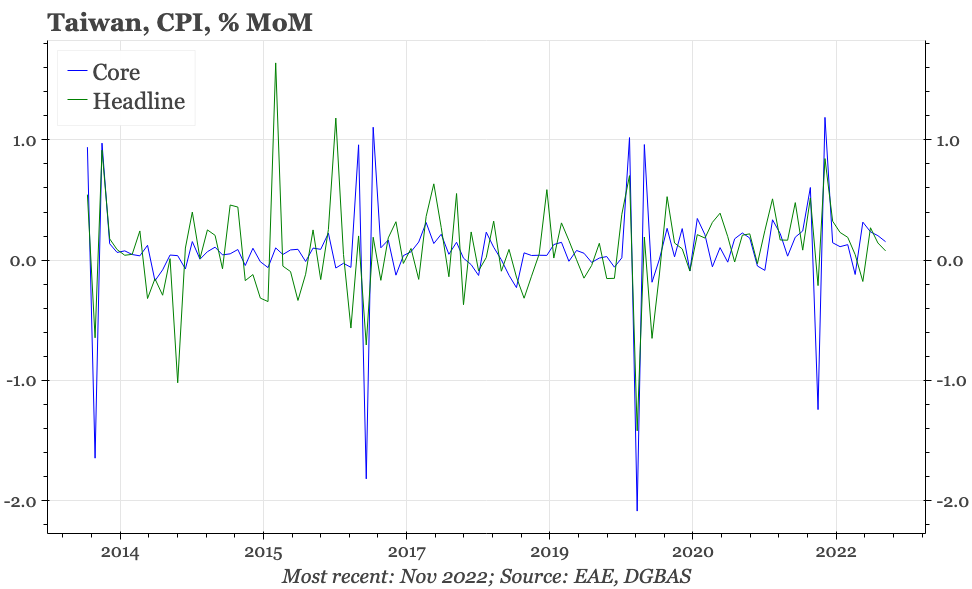

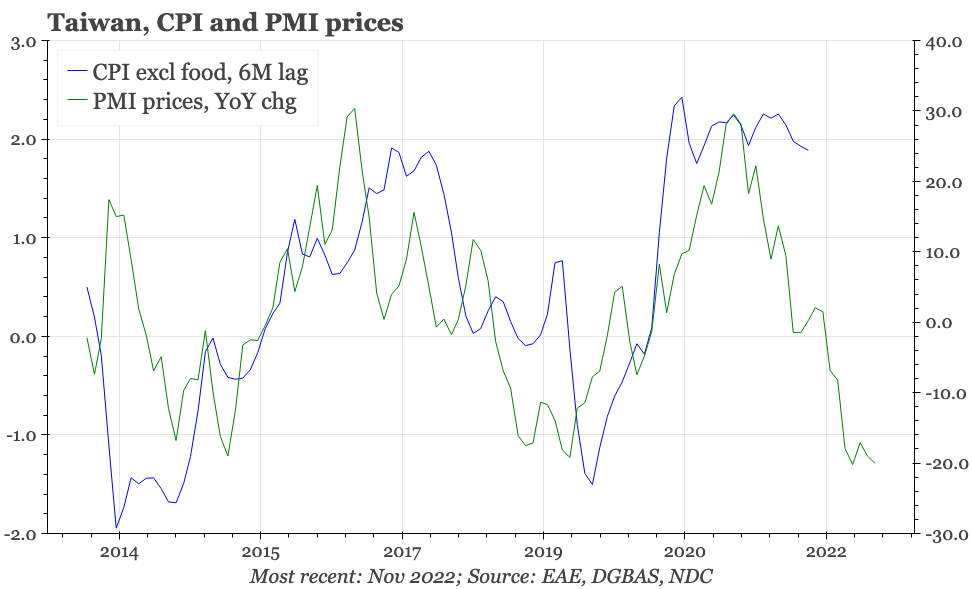

These decreases look to have been driven by falls in volumes. Official quantity data for November hasn't yet been announced, but Taiwan's November Price Index release yesterday showed export prices basically unchanged last month. For export values, there is likely further downside ahead, with various leading indicators pointing to export values falling 15-20% YoY in Q123.

This is a sharp change in direction. In interpreting its significance, it is important to remember the context, namely the huge increase in Taiwan's exports that happened with the onset of the covid pandemic; even after the recent falls, Taiwan's exports are still a quarter higher than they were in December 2019. There is no reason for the CBC to be particularly panicking about the export fall.

That said, I'd still think that when cutting starts, Taiwan will be at the head of the queue. Apart from flat export prices, yesterday's release also showed sequential headline and core CPI inflation dropping below 0.2% in the three months to November. For core, that is still higher than usual, which again means it is early yet to be expecting any policy change. But the leads for inflation are mainly pointing down, and with the labour market not especially tight, Taiwan does have policy space to react to the slowdown in exports.