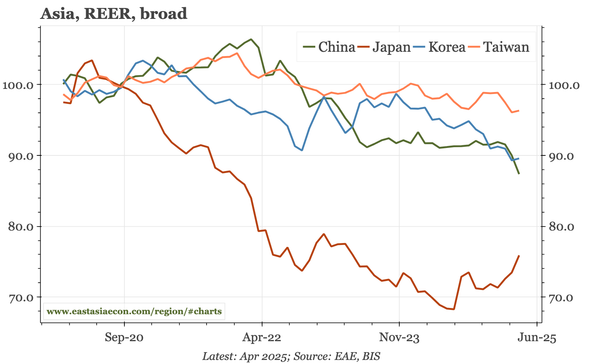

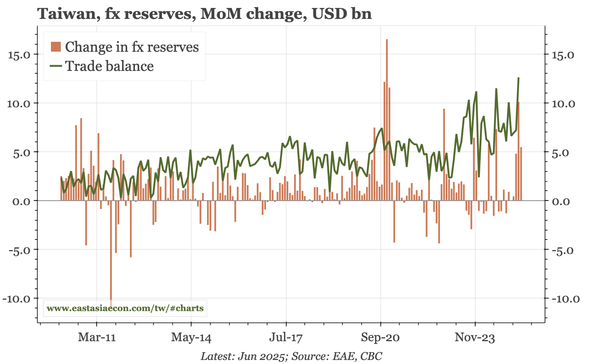

Taiwan – another hefty rise in fx reserves

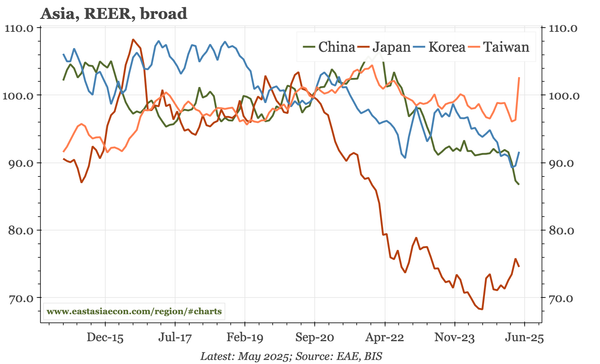

At USD5.5bn, June's rise in reserves wasn't as big as May's USD10bn. But it is the first time since 2020 that reserves have grown by over USD5bn for two months running. If lifers/corporates are less willing to recycle the rising trade surplus, the CBC has to step in – or the TWD strengthens more.