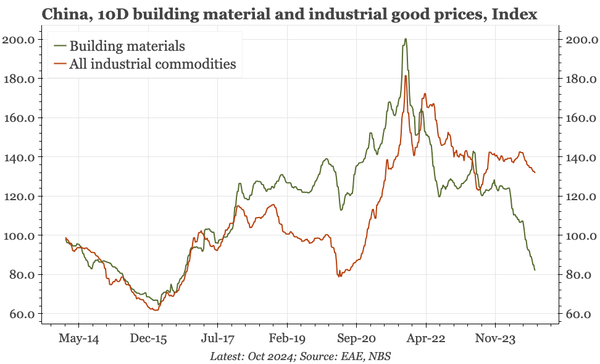

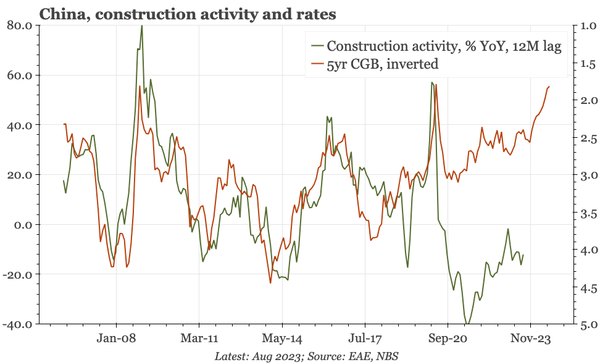

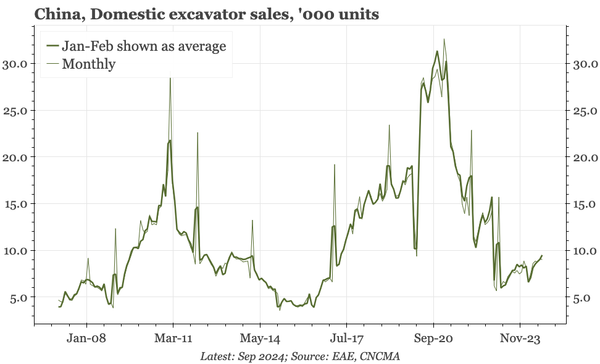

China: excavator sales still 70% below the peak

Excavator sales are a good illustration of China's woes. Sales fell more after 2020 than they did following the 2009 boom. It is interesting that they have seem to have now bottomed out, but that still leaves them 70% below the peak. To turn things around, policy has a lot of work to do.