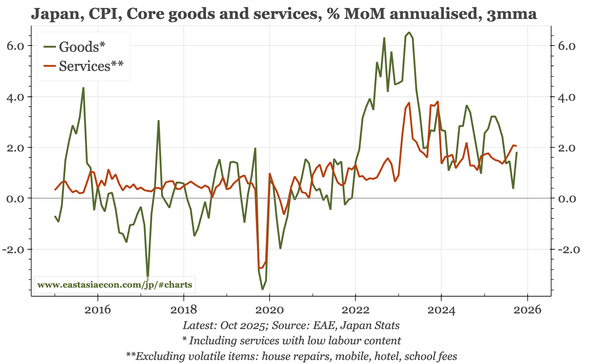

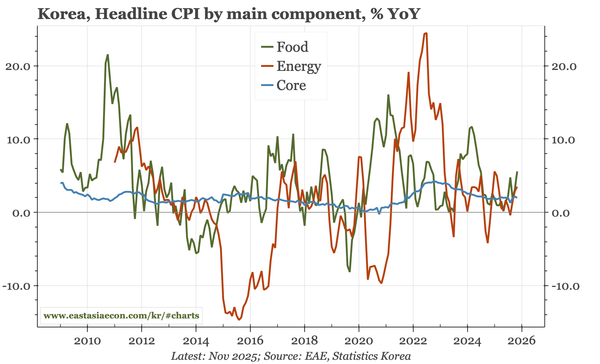

Korea – core inflation stable, but not low

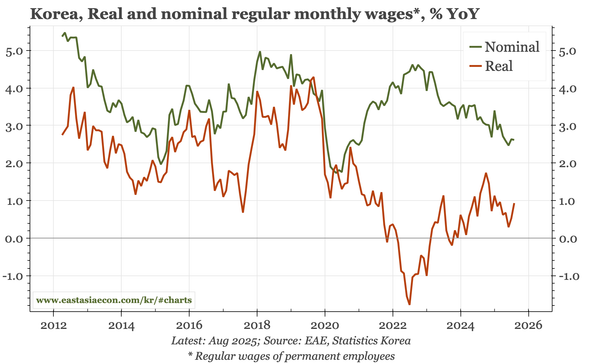

The BOK says the rise in headline CPI inflation to 2.4% the last couple of months is temporary, and that core is stable. That isn't an unreasonable assessment. However, I'd continue to highlight the strength of services inflation, which remains firm reltive to ongoing labour market weakness.

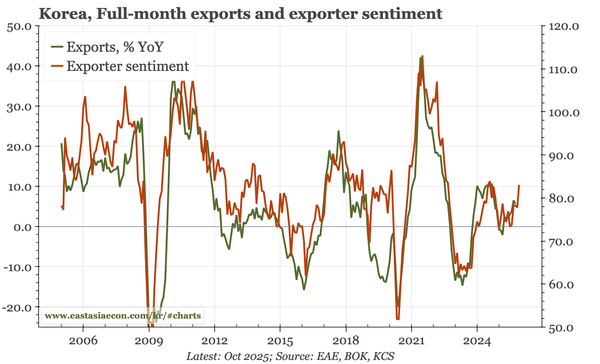

Region – manufacturing PMIs and Korean exports

The mfg PMIs across the region mainly remain below 50. That shows that conditions outside of semiconductors remain poor. Semi is strong, and in Korean in export data for November, are departing from a normal cycle. Goods input prices pressures are rebounding, reflecting weak currencies.

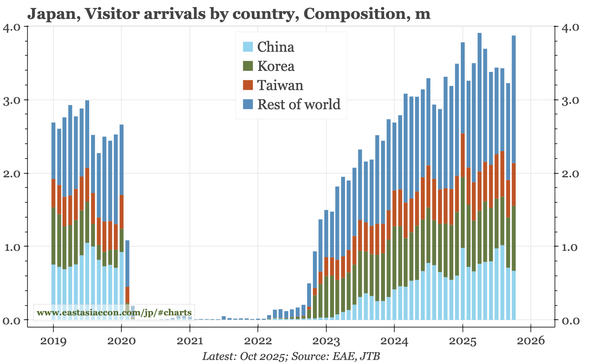

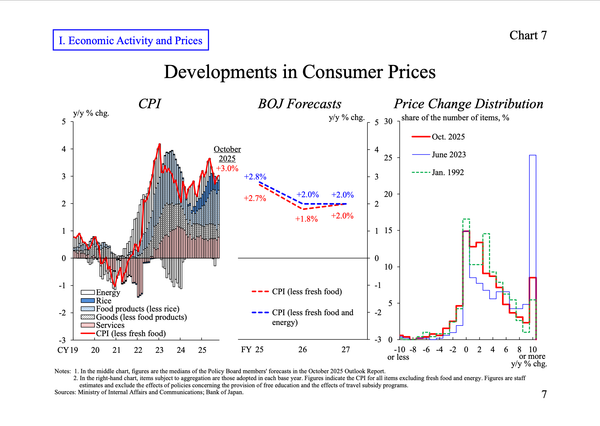

Japan – Ueda becomes constructive again

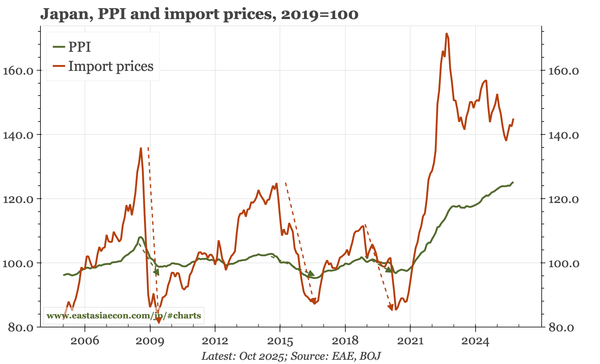

The tone of governor Ueda's speech today suggests a rate hike is close. He claims that risks to the US are receding, identifies five recent positive wage developments, and with firms' price and wage behaviour changing, argues that exchange rate changes are more likely to affect prices.

Last week, next week

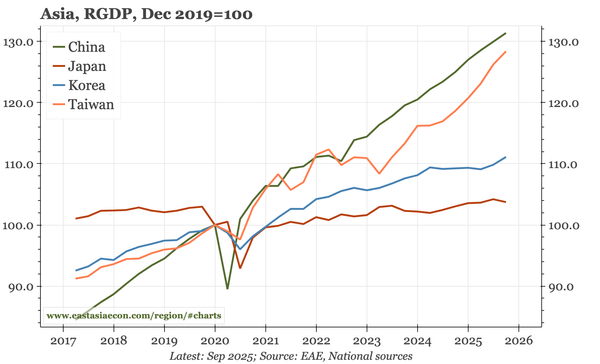

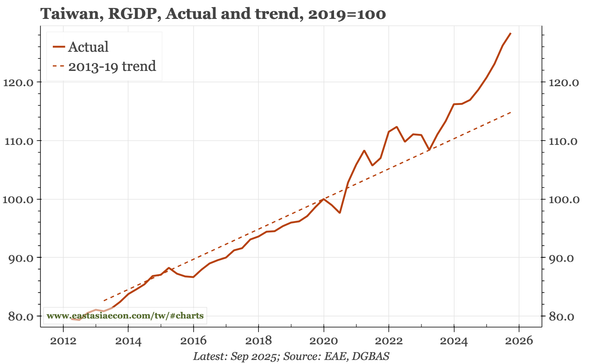

The main themes: stabilisation in China, but the picture is muddy; the discrepancy between clear economic boom in Taiwan versus stability in inflation and TWD; upside risks in Korea that still look like risks than reality; the BOJ facing a real fiscal boost when the economy is already recovering.

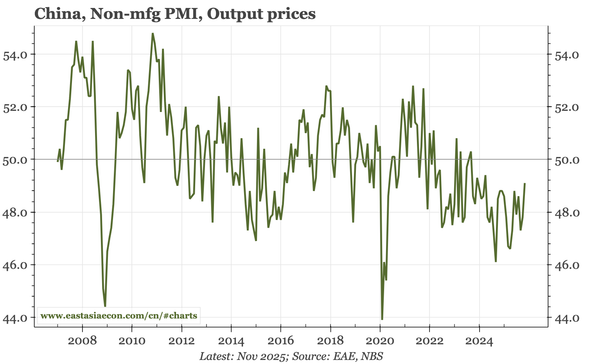

China – more data puzzles

The official composite output PMI in November fell below 50. That wasn't because of FAI: the industrial PMIs were stable. Rather, it was weakness in services. That is puzzling. For now, the one concrete indicator from today's inflation is actually positive: deflation isn't getting worse.

Taiwan – everything revised up, except inflation

In today's GDP release, the government raised estimated growth for Q1, Q2, and Q3. The FY forecast was raised by almost 3ppts to 7.4%. But because of AI, officials remain bullish about the outlook, and so raised the forecast for 2026 as well, And yet, none of this is expected to impact inflation.

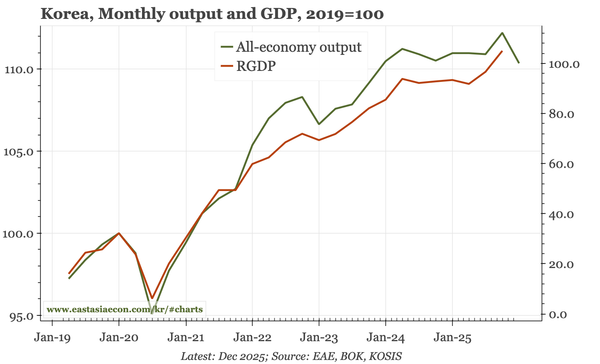

Korea – still no clear lift in growth

The BOK's revisions to the GDP outlook yesterday were modest. But in today's October output data, there's little sign of any improvement at all. The data are affected by the long Chuseok holiday, and will likely look better through year-end. Still, it is clear the economy still faces headwinds.

Korea – was when, now also whether

The BOK didn't raise growth forecasts above potential, but still signalled some concern about the resilience of inflation. That sounds a touch stagflationary, and was used to justify a step back from its loosening stance. Growth only gets above potential in its chip-driven upside scenario.

Japan – SPPI inflation soft in October

Headline SPPI inflation was stable in October, but weak for high labour-intensive sectors, while part-time wages were strong, likely on the back of the minimum wage hike. That's an unclear picture. But right now, with the JPY so weak, the BOJ will focus more on headline CPI than these messy details.

Korea – below potential, but are risks skewed to the upside?

I doubt the BOK can raise '26 growth forecasts above its estimate of potential and so shift its loosening stance. What's the wriggle room around that? 1) It says the memory cycle means risks are skewed to the upside 2) Citing financial stability risks, more members suggest rates won't change.

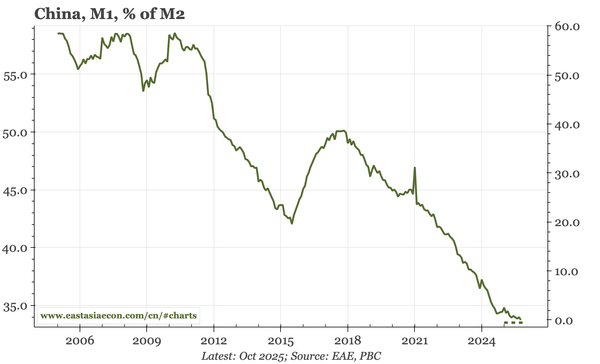

China – prices and demand deposits stable

The FAI data point to the economy hitting a wall. But price data don't bear that out. Indeed, upstream prices show the recent stability of PPI is likely persisting. That is also true for the demand:time deposit ratio. The cycle as a whole remains both weak and messy, but there are some green shoots.

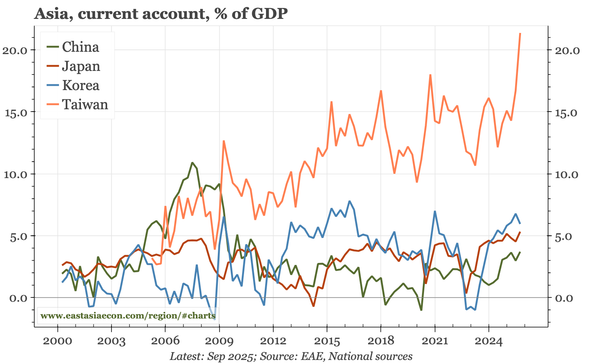

Last week, next week

Japan is doing macro stimulus when the cycle really doesn't need it. China isn't doing any when the cycle still does. The first keeps the JPY weak. The second prevents the CNY from appreciating. Both in turn weigh on the KRW and TWD, despite substantial current account surpluses across the region.

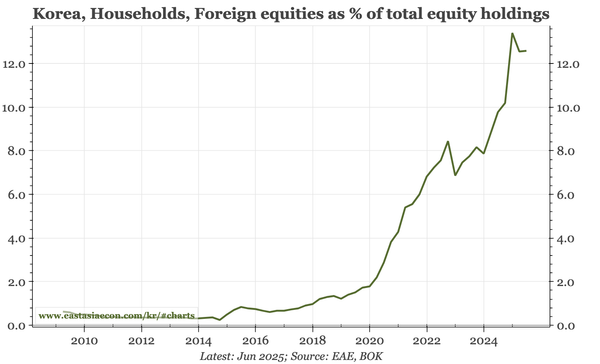

Korea – household offshore equity buying and the KRW

Global factors like US rates and JPY weakness are dragging down the KRW. But there are also local drivers, particularly Korea's big buying of overseas equities. For both the NPS and households, I would expect that to slow, with the reversal likely to be sharp if global markets really sell off.

China – not yet soft enough

The October data are soft, but mixed: on the one hand investment terrible and property weak, on the other, output and services more stable. That probably doesn't add up to a change in policy. My idea of stabilisation does look a bit more tenuous, and would be over if upstream prices give way again.

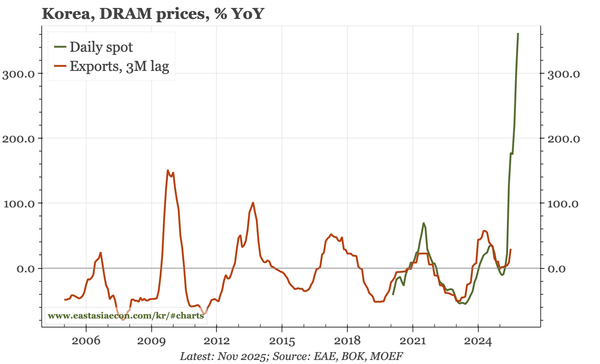

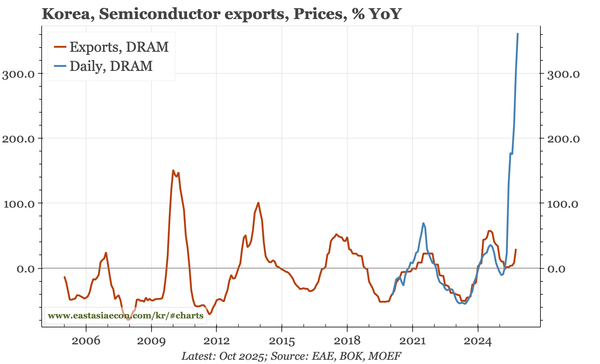

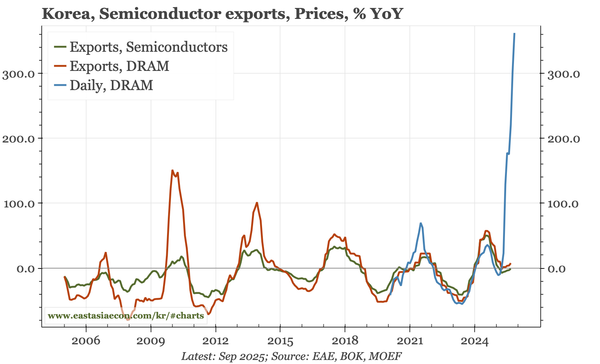

Korea – watching semi export prices

Import prices are rising, but not by enough to think upstream inflation is about to explode. More interesting are export prices. Auto export prices aren't rebounding. By contrast, semiconductor export prices seem to be gaining upwards momentum – which is important given the rise in spot DRAM prices.

China – monetary data a bit softer in October

Relative to my idea that the underlying economy could be stabilising, today's monetary data for October are a little soft. In particular, both M1 growth and the M1:M2 ratio ticked down, and mortgage lending also slowed. Credit growth also dropped, but only because of less government borrowing.

Japan – PPI still rising

The gap between import prices and PPI in the October data illustrates the sort of pent-up inflationary pressure in Japan that is likely to be exposed if the JPY remains so weak. Today's data also show a decent rise in auto export prices, but to a level that is still 6% below the pre-tariff level.

Korea – "financial dominance"

With October meeting minutes, export and labour market data, there's enough to review the outlook for Korea. I think the underlying economic picture remains consistent with more cuts. But the minutes show Board members continuing to prioritise concerns about KRW weakness and house price strength.

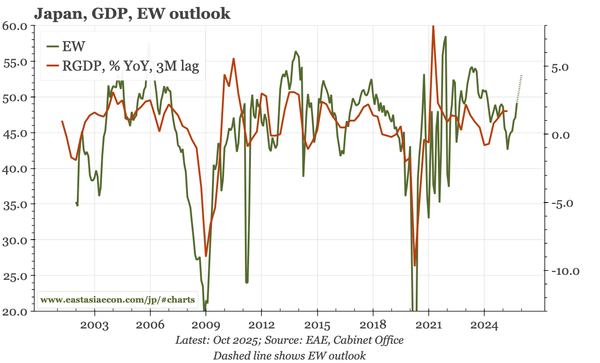

Japan – EW survey lifts strongly

The sharp recovery in sentiment in the EW survey continued in October. The improvement is broad-based, affecting both corporates and households. That shows a lessening of the tariff and inflation shocks of 1H25, and should be reflected in the BOJ becoming more optimistic about the outlook.

Japan – Board thinks the time for another hike is getting closer

The summary of the October BOJ meeting show a stronger consensus that the time is approaching for another rate hike. That is partly because concern about tariffs is fading. It is less about domestic demand: data today show consumption trending up, but still only very slowly.

Last week, next week

Data last week showed Taiwan remaining as one of the world's major beneficiaries of AI adoption. A big question for 2026 is whether Korea joins the party. Other themes are fiscal uncertainty in Japan, and further signs of stabilisation in China's underlying cycle.